Bank of England raises Interest Rate to 5%

22-06-2023, 20:15

22-06-2023, 20:15

|

#16

|

|

cf.mega poster

Join Date: Feb 2012

Posts: 4,425

|

Re: Bank of England raises Interest Rate to 5%

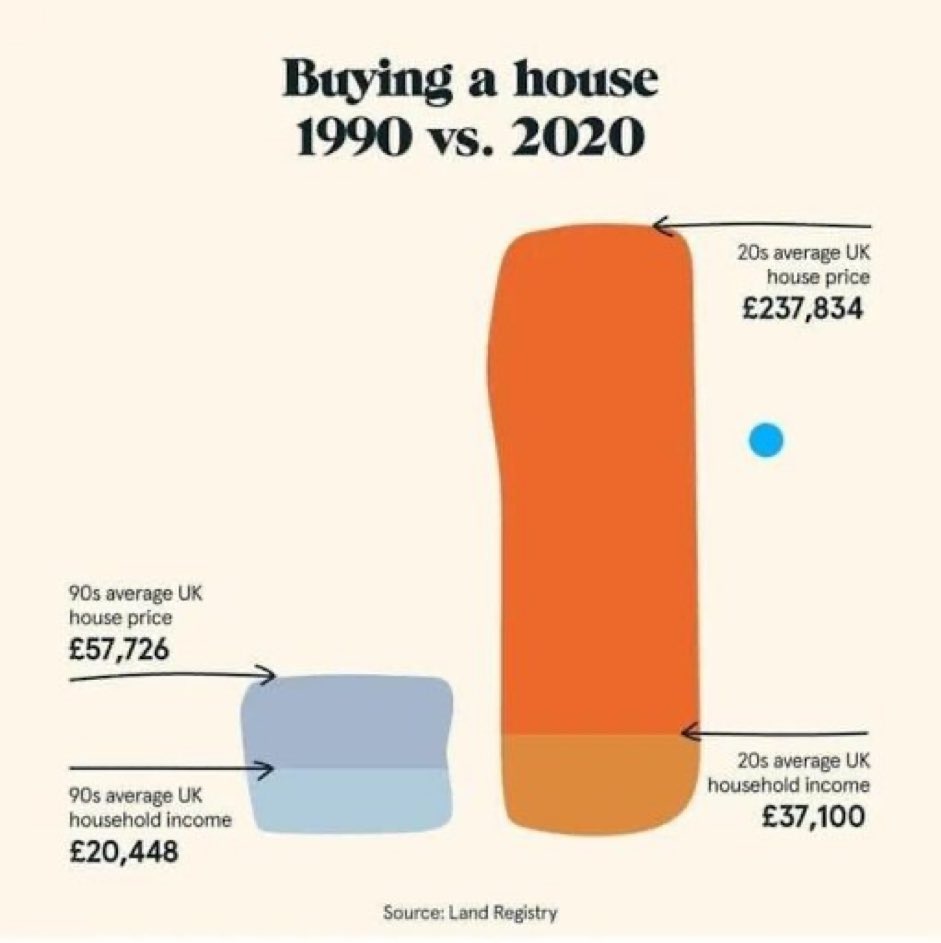

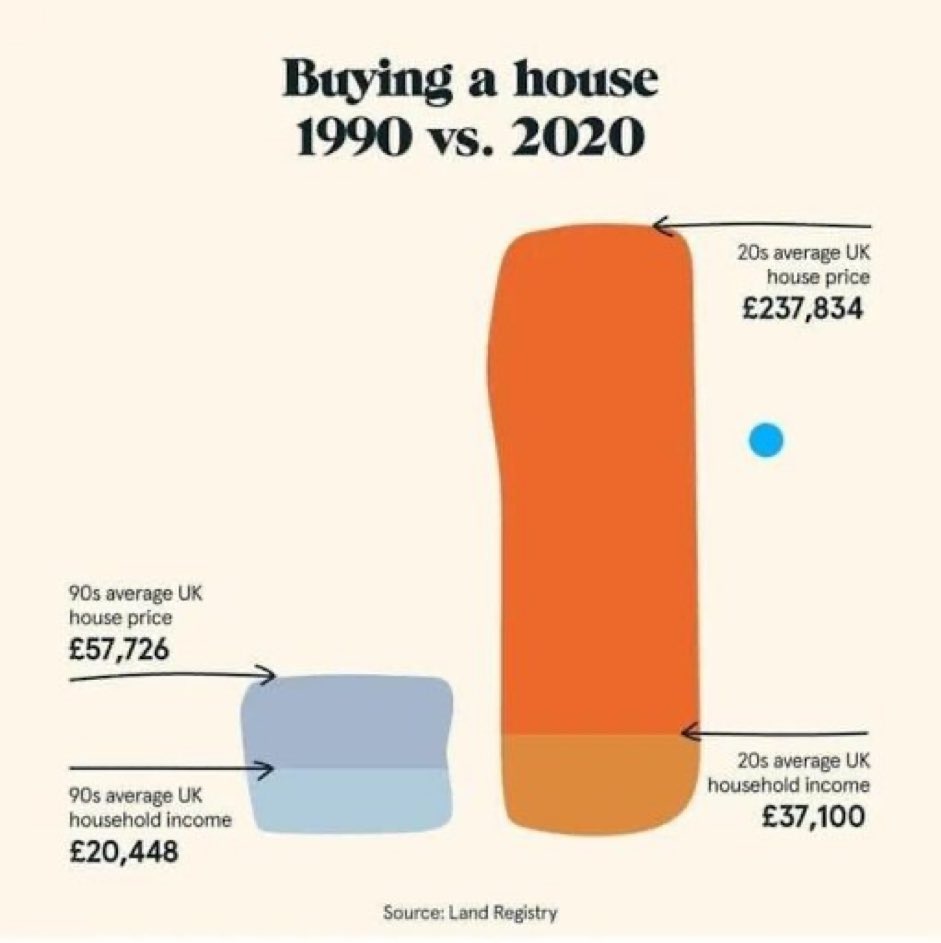

There is no comparison with the earlier decades due to the differential rates of increase of wages and house prices:

---------- Post added at 20:15 ---------- Previous post was at 20:12 ----------

Interesting UK Interest Rate chart:

https://thinkplutus.com/uk-interest-rate-history/

__________________

Unifi Express + BT Whole Home WiFi | VM 1Gbps

|

|

|

22-06-2023, 21:04

22-06-2023, 21:04

|

#17

|

|

cf.mega poster

Join Date: Jan 2008

Location: Up North - Where It's Grim

Age: 56

Posts: 2,344

|

Re: Bank of England raises Interest Rate to 5%

When we jumped back on the mortgage band waggon in September 2018 we fixed the rate at 2.64% for 10 years. Seemed a no brainer as interest rates were so low there was only one way they were going to go.

We have unlimited over payments allowed but a high early repayment charge so have so keep it for the initial 10 years, so we are putting best part of £1000 away each month to clear it when the fix ends.

|

|

|

22-06-2023, 21:17

22-06-2023, 21:17

|

#18

|

|

Architect of Ideas

Join Date: Dec 2004

Posts: 10,366

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by GrimUpNorth

When we jumped back on the mortgage band waggon in September 2018 we fixed the rate at 2.64% for 10 years. Seemed a no brainer as interest rates were so low there was only one way they were going to go.

We have unlimited over payments allowed but a high early repayment charge so have so keep it for the initial 10 years, so we are putting best part of £1000 away each month to clear it when the fix ends.

|

Some good rates on savings accounts right now will dwarf the interest at that mortgage rate.

|

|

|

22-06-2023, 23:15

22-06-2023, 23:15

|

#19

|

|

Dr Pepper Addict

Cable Forum Team

Join Date: Oct 2003

Location: Nottingham

Age: 61

Services: Flextel SIP : Sky Mobile : Sky Q TV : VM BB (1000 Mbps) : Aquiss FTTP (330 Mbps)

Posts: 27,730

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by Pierre

Having paid off my mortgage last year, I'm even smugger.

|

I am fortunate to be in this smug camp. I paid mine off a few years ago now.

My savings account rates have gone up slightly, though not as high as inflation, but every little bit helps.

__________________

Baby, I was born this way. Baby, I was born this way.

|

|

|

23-06-2023, 09:28

23-06-2023, 09:28

|

#20

|

|

Virgin Media Employee

Join Date: Sep 2005

Location: Winchester

Services: Staff MyRates

BB: VM XXL

TV: VM XL

Phone : VM XL

Posts: 3,115

|

Re: Bank of England raises Interest Rate to 5%

One problem is that property is thought of simply as an investment so if/when prices drop there is going to be an investment market with the resources to buy property. Sometimes the buyer will be people buying second/holiday homes and in other cases investment companies or developers who can weather the storm.

A further problem is that areas with housing capacity are areas people don't want to move to. I guess companies/department could relocate nearer those areas creating demand but a downside would be rising property prices that locals in lower paid jobs could no longer afford. We can't simply keep building in areas with high demand as the demand will likely never go away and the infrastructure and resources (eg water) are limited.

__________________

I work for VMO2 but reply here in my own right. Any help or advice is made on a best-effort basis. No comments construe any obligation on VMO2 or its employees.

|

|

|

24-06-2023, 21:38

24-06-2023, 21:38

|

#21

|

|

[NTHW] pc clan

Join Date: Jun 2003

Location: Tonbridge

Age: 56

Services: Amazon Prime Video & Netflix. Deregistered from my TV licence.

Posts: 21,950

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by Chris

Luck schmuck Ö. The writing was already on the wall at the beginning of last year for those willing to see it. Perhaps being old enough to remember high rates in the late 80s/early 90s gave me more perspective than those a few years younger but even so, it was pretty clear to me that the modest additional monthly cost of fixing for 5 years would be more than offset by not having to deal with rates as they will be this time next year.

|

Indeed. The last 20 or so years of freakishly low rates have been very odd. My mortgages are fixed till 2026 by which time they should be paid off anyway.

__________________

Step by step, walk the thousand mile road...

-----------------------------------------------------

|

|

|

26-06-2023, 15:49

26-06-2023, 15:49

|

#22

|

|

cf.mega poster

Join Date: Jun 2003

Location: Kairdiff-by-the-sea

Age: 68

Services: TVXL BBXL Superhub 2ac (wired) 1Tb Tivo

Posts: 9,812

|

Re: Bank of England raises Interest Rate to 5%

Rate rises hit those who already have loans. But the idea behind them is to put people (and businesses) off taking out new loans to slow the economy.

Why not make the rate rises only apply to new loans?

Or would that hurt the banks too much?

|

|

|

26-06-2023, 16:08

26-06-2023, 16:08

|

#23

|

|

Architect of Ideas

Join Date: Dec 2004

Posts: 10,366

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by Taf

Rate rises hit those who already have loans. But the idea behind them is to put people (and businesses) off taking out new loans to slow the economy.

Why not make the rate rises only apply to new loans?

Or would that hurt the banks too much?

|

It also encourages savers to save. Not so much when the rate is below inflation, but if you have any confidence in the Government to do so thereís a few 5%+ products out there for 3/5 years now. And likely to be more in the coming months.

|

|

|

26-06-2023, 17:52

26-06-2023, 17:52

|

#24

|

|

Trollsplatter

Cable Forum Team

Join Date: Jun 2003

Location: North of Watford

Services: Humane elimination of all common Internet pests

Posts: 36,930

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by Taf

Rate rises hit those who already have loans. But the idea behind them is to put people (and businesses) off taking out new loans to slow the economy.

Why not make the rate rises only apply to new loans?

Or would that hurt the banks too much?

|

That would require direct intervention in the commercial operations of private businesses - difficult and controversial, as it would require carefully constructed primary legislation to enable it.

By altering its own interest rate the Bank of England isn’t intervening directly in anyone else’s business, but is in effect changing the terms on which it does business with others. Exploiting its unique position at the heart of the financial system ensures its actions have significant effects on the wider system.

|

|

|

26-06-2023, 18:26

26-06-2023, 18:26

|

#25

|

|

Architect of Ideas

Join Date: Dec 2004

Posts: 10,366

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by Chris

That would require direct intervention in the commercial operations of private businesses - difficult and controversial, as it would require carefully constructed primary legislation to enable it.

By altering its own interest rate the Bank of England isnít intervening directly in anyone elseís business, but is in effect changing the terms on which it does business with others. Exploiting its unique position at the heart of the financial system ensures its actions have significant effects on the wider system.

|

A touching story of course of little comfort for mortgage holders whose debt was created out of thin air, rather than a transaction between their bank and any other, or a central bank.

|

|

|

26-06-2023, 18:30

26-06-2023, 18:30

|

#26

|

|

cf.mega poster

Join Date: Jun 2003

Location: Kairdiff-by-the-sea

Age: 68

Services: TVXL BBXL Superhub 2ac (wired) 1Tb Tivo

Posts: 9,812

|

Re: Bank of England raises Interest Rate to 5%

I know of many people who got loans and mortgages at a fixed percentage for the term of the contract, or at least several years.

|

|

|

26-06-2023, 18:49

26-06-2023, 18:49

|

#27

|

|

Trollsplatter

Cable Forum Team

Join Date: Jun 2003

Location: North of Watford

Services: Humane elimination of all common Internet pests

Posts: 36,930

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by jfman

A touching story of course of little comfort for mortgage holders whose debt was created out of thin air, rather than a transaction between their bank and any other, or a central bank.

|

The licensed creation of money in order to finance a loan is less problematic than the subsequent selling on of packages of these debts until nobody quite knows what is where. We havenít actually solved that structural weakness since 2008 - all weíve really done is force the system to hoard enough real cash to plug the holes next time the dam starts to burst. And we wonít know whether the banks have actually done that, or just found a clever way to make it look like they have, until itís too late.

|

|

|

26-06-2023, 18:50

26-06-2023, 18:50

|

#28

|

|

Do I care what you think

Join Date: Jul 2006

Location: Cardiff South Wales

Age: 73

Services: V6 ,Virgin L. Phone Broadband.sky go Netflix

Posts: 4,278

|

Re: Bank of England raises Interest Rate to 5%

The whole point ( not saying its correct) is too take money out of people's pockets, with less to spend the hope is that prices will fall ( supply and demand) the other side is increase saving rates ,to again take money out of the system. Don't forget there are more savers than mortgage holders.and with out them less mortgages, else they borrow more money from the wholesale market.

__________________

No point in being pessimistic. You know it won`t work.

|

|

|

26-06-2023, 18:53

26-06-2023, 18:53

|

#29

|

|

Trollsplatter

Cable Forum Team

Join Date: Jun 2003

Location: North of Watford

Services: Humane elimination of all common Internet pests

Posts: 36,930

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by Taf

I know of many people who got loans and mortgages at a fixed percentage for the term of the contract, or at least several years.

|

Full-term fixed rates are fairly common in some other countries (the French like them, IIRC). You can get them here but there arenít many choices so theyíre not often competitive. I asked my mortgage adviser to present options to fix rates for 5 or 10 years when we moved house last year. She wanted to push a lot of 2 year deals but I thought this was too risky.

Iíd have liked to have taken a 10 year fix but even at 10 years the competitiveness of the rate dropped right off compared to the difference between 2 and 5 years. So we went with the 5, and we will just have to see how things are looking come 2027.

|

|

|

26-06-2023, 19:57

26-06-2023, 19:57

|

#30

|

|

The Dark Satanic Mills

Join Date: Dec 2003

Location: floating in the ether

Posts: 12,041

|

Re: Bank of England raises Interest Rate to 5%

Quote:

Originally Posted by ianch99

There is no comparison with the earlier decades due to the differential rates of increase of wages and house prices:

---------- Post added at 20:15 ---------- Previous post was at 20:12 ----------

Interesting UK Interest Rate chart:

https://thinkplutus.com/uk-interest-rate-history/

|

This is potentially the most important post on this thread. House prices have rocketed and salaries have not kept up. I bought my first house in 1999. I was on £25,000 and Mrs Pierre was on around £15,000 and the house cost £59,950.

That said itís also about aspirations, thereís plenty of properties at reasonable prices around here, but you wouldnít want to live there!!!

---------- Post added at 19:55 ---------- Previous post was at 19:42 ----------

Quote:

Originally Posted by jfman

A touching story of course of little comfort for mortgage holders whose debt was created out of thin air, rather than a transaction between their bank and any other, or a central bank.

|

The problem is that the BoE have one tool and one tool only.

Itís not the free spending of the population that is causing inflation, weíre in the middle of a cost of living crisis!

Iím not an economist and I am likely talking bollocks, but if between 2008 to now, the BoE had llifted rates up to around 5%, they would have some room in which to play.

They could have lowered interest rates to alleviate the cost of living crisis, stimulate the economy and it wouldnít have really impacted inflation as this inflation is not caused by us spending like crazy.

---------- Post added at 19:57 ---------- Previous post was at 19:55 ----------

Quote:

Originally Posted by Itshim

The whole point ( not saying its correct) is too take money out of people's pockets, with less to spend the hope is that prices will fall ( supply and demand) the other side is increase saving rates ,to again take money out of the system. Don't forget there are more savers than mortgage holders.and with out them less mortgages, else they borrow more money from the wholesale market.

|

Yes, essentially/ historically inflation is the causality between supply and demand. But this round of inflation is not so simplistic.

__________________

The wheel's still turning but the hamsters dead.

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT +1. The time now is 22:37.

|

Join CF

Join CF