Quote:

Originally Posted by ianch99

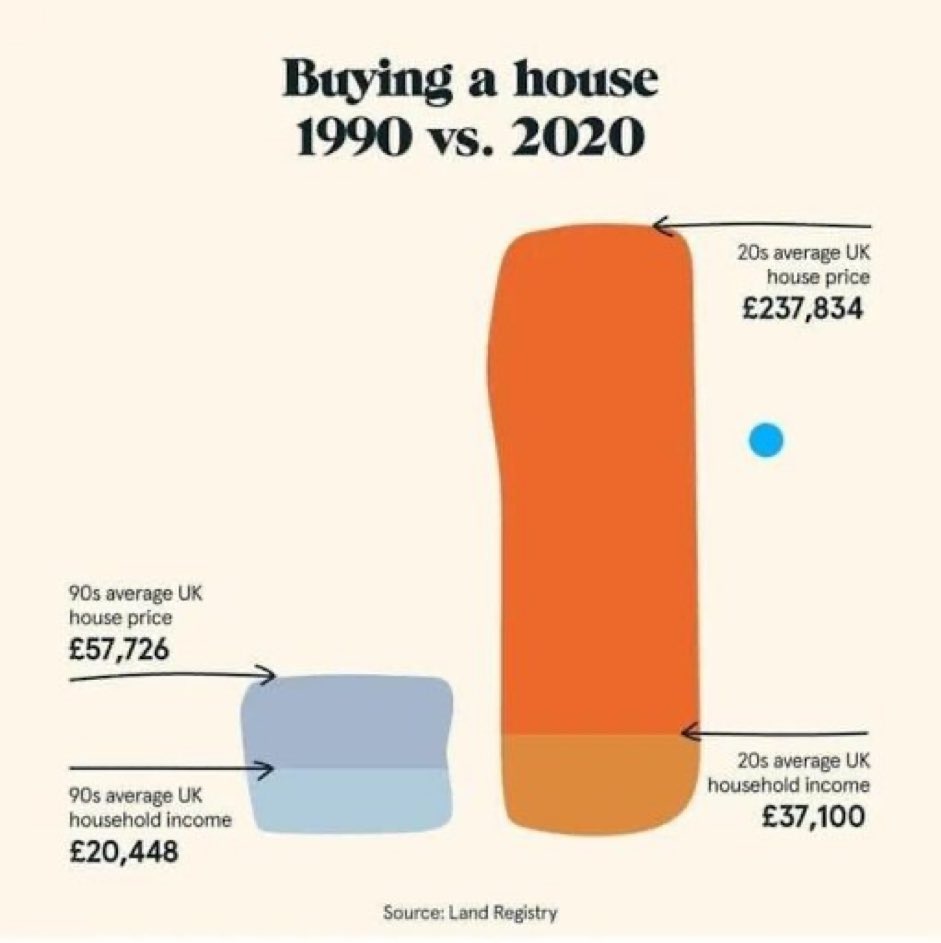

There is no comparison with the earlier decades due to the differential rates of increase of wages and house prices:

---------- Post added at 20:15 ---------- Previous post was at 20:12 ----------

Interesting UK Interest Rate chart:

https://thinkplutus.com/uk-interest-rate-history/

|

This is potentially the most important post on this thread. House prices have rocketed and salaries have not kept up. I bought my first house in 1999. I was on £25,000 and Mrs Pierre was on around £15,000 and the house cost £59,950.

That said it’s also about aspirations, there’s plenty of properties at reasonable prices around here, but you wouldn’t want to live there!!!

---------- Post added at 19:55 ---------- Previous post was at 19:42 ----------

Quote:

Originally Posted by jfman

A touching story of course of little comfort for mortgage holders whose debt was created out of thin air, rather than a transaction between their bank and any other, or a central bank.

|

The problem is that the BoE have one tool and one tool only.

It’s not the free spending of the population that is causing inflation, we’re in the middle of a cost of living crisis!

I’m not an economist and I am likely talking bollocks, but if between 2008 to now, the BoE had llifted rates up to around 5%, they would have some room in which to play.

They could have lowered interest rates to alleviate the cost of living crisis, stimulate the economy and it wouldn’t have really impacted inflation as this inflation is not caused by us spending like crazy.

---------- Post added at 19:57 ---------- Previous post was at 19:55 ----------

Quote:

Originally Posted by Itshim

The whole point ( not saying its correct) is too take money out of people's pockets, with less to spend the hope is that prices will fall ( supply and demand) the other side is increase saving rates ,to again take money out of the system. Don't forget there are more savers than mortgage holders.and with out them less mortgages, else they borrow more money from the wholesale market.

|

Yes, essentially/ historically inflation is the causality between supply and demand. But this round of inflation is not so simplistic.